Video Chat Network is putting two qualitative market research methods to the test to reveal which produces the meatiest consumer insights. We conducted a study to compare the nature of consumer feedback provided in real-time via smartphone vs. after-the-fact via webcam.

VCN Founder & CEO Rachel Geltman will be presenting our findings at the MRMW and CASRO conferences in Chicago on May 28th and 29th, as part of each conference’s focus on emerging technologies in qualitative market research.

Titled “The Visceral Power of Mobile Insights”, our study reveals smartphones to be the ultimate qualitative research stimulus.

Read on to learn more about the study and what we’ve learned so far!

The Study:

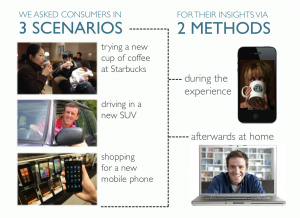

VCN conducted video chats with consumers in real time through their mobile phones. Consumers were interviewed in 3 different scenarios: trying a new type of coffee at Starbucks, driving in a new SUV and shopping for a new mobile phone.

VCN conducted video chats with consumers in real time through their mobile phones. Consumers were interviewed in 3 different scenarios: trying a new type of coffee at Starbucks, driving in a new SUV and shopping for a new mobile phone.

VCN then video chatted with another set of consumers who also had these 3 types of experiences – the only difference being that these interviews were conducted post-experience via video chat at home.

The Findings:

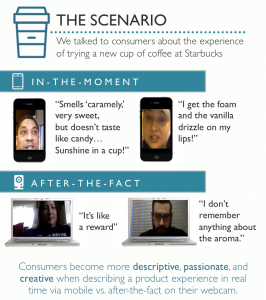

A key insight that emerged from our study is that consumers became more descriptive, passionate, and creative when describing a product experience in real time via mobile vs. after-the-fact.

When trying a new coffee drink at Starbucks, our mobile respondents used colorful descriptions like “caramel-y”, and “sunshine in a cup!” They described the experience of tasting a new drink with vivid language: “I get the foam and the vanilla drizzle on my lips!”

When trying a new coffee drink at Starbucks, our mobile respondents used colorful descriptions like “caramel-y”, and “sunshine in a cup!” They described the experience of tasting a new drink with vivid language: “I get the foam and the vanilla drizzle on my lips!”

Respondents that were interviewed after-the-fact were able to recall much less about the product experience. “I don’t remember anything about the aroma,” admitted one respondent. The insights they gave were more generic: “it’s like a reward” and “it’s kinda my starter for the day.” These insights reflect the type of expected opinions that could describe any coffee-drinking experience.

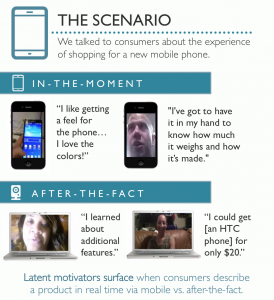

Mobile video chats were consistently more effective in capturing the subjective aspects of the consumer experience. Not only did shoppers become more descriptive in their language, they were also more likely to bring up subjective product benefits.

Our real-time chats with consumers shopping for a new mobile phone show how latent motivators surface when consumers describe a product experience in real time.

“I like getting a feel for the phone… I love the colors!” said one of our mobile respondents. Visual and tactile characteristics were a more expressed priority to this group: “I’ve got to have it in my hand to know how much it weighs and how it’s made.”

“I like getting a feel for the phone… I love the colors!” said one of our mobile respondents. Visual and tactile characteristics were a more expressed priority to this group: “I’ve got to have it in my hand to know how much it weighs and how it’s made.”

In contrast, the respondents we chatted to after their shopping experience were more likely to recall and focus on functional benefits like price, features, and services. They did not recall the experiential elements of browsing phones so much as the conversations they had with store salespeople. “I learned about additional features,” said one respondent, “He said the HTC was the one people are going for now…I could get one for only $20”.

Besides surfacing product features that are less conventional than what is standardly heard in qualitative research (e.g., steering wheel and knob on climate control), mobile respondents were more likely to communicate traditional category benefits in more unique ways.

Our video chats with consumers driving in a new SUV exemplify this contrast. When interviewed after the driving experience via webcam, consumers had conventional ways of describing category benefits: “I feel comfortable putting my kids in there… It’s reliable, dependable.”

The connection between family safety and vehicle reliability is an obvious one that is frequently driven home in car commercials. Mobile respondents made more surprising connections between product features and benefits: “I love how it feels… It lets me be more aggressive, for me that’s practical.”

The connection between family safety and vehicle reliability is an obvious one that is frequently driven home in car commercials. Mobile respondents made more surprising connections between product features and benefits: “I love how it feels… It lets me be more aggressive, for me that’s practical.”

The notion that a practical car is one that allows the driver to be more aggressive is a much more unexpected consumer insight. Mobile respondents were repeatedly more likely to choose descriptive words that led to these unique spins on mandatory features: “So smooth, easy… It just makes it effortless.”

The description of a smooth driving experience as being “effortless” offers a more unique consumer insight for marketers to leverage. On the other hand, non-mobile respondents spoke to the product benefits in a much more conventional way: “I like that feeling of being higher on top of the road.”

Want to learn more about our findings with this groundbreaking study? Watch Rachel Geltman present on the power of mobile market research at this year’s MRMW and CASRO conferences and be on the lookout for a link to the presentation in the coming weeks!